The FILTHIEST … DIRTIEST … INSIDE GOVERNMENT COVER UP AND HEIST IN WORLD HISTORY

The Great American Laundromat

Real Estate and Money Laundering 101

Head of Anti-Money Laundering Agency Tells Senate Hearing He Hasn’t Read the Times Bombshell on Trump, Kushner and Deutsche Bank

By Pam Martens and Russ Martens: May 22, 2019 ~

Reading the New York Times is apparently now seen as being disloyal to the President of the United States if you’re a Federal employee. Just holding the newspaper in one’s hands might be enough to become an early pensioner in the Trump administration. Yesterday it became crystal clear at a Senate Banking hearing just how terrified people are in the Federal government of getting on the wrong side of the President and ending up being publicly bashed on his Twitter page.

The Senate Banking hearing on Tuesday was called to get answers from the witness panel on how to combat money laundering in the United States by shell companies that keep their real owners a secret. But it quickly became a hearing also about the bombshell report from the New York Times on Sunday. That article, by David Enrich, describes how a Deutsche Bank whistleblower, Tammy McFadden, and four of her colleagues had their efforts blocked by the bank when they tried to file suspicious activity reports on bank accounts affiliated with Jared Kushner and Donald Trump. Those reports should have gone to the Federal agency that oversees potential money laundering activity, the Financial Crimes Enforcement Network or FinCEN, but they were quashed by a unit of the bank that manages money for the super wealthy.

The Director of FinCEN, Kenneth Blanco, was on the witness panel for the hearing. When Blanco was asked by Senator Bob Menendez if he had read the article in the New York Times, Blanco said that he had not, adding that he had simply been “briefed” on it. This statement appeared to be little more than an effort to appease the anger of Trump toward the New York Times (the President regularly calls it “Fake News”) since it would be negligence on the part of the Director of FinCEN not to read a whistleblower’s account of what went on inside Deutsche Bank – especially given Deutsche Bank’s 2017 fine of $630 million for laundering $10 billion out of Russia.

Blanco also refused to answer any questions as to whether he was or was not opening an investigation as a result of the report in the Times. That elicited a stern statement to Blanco from Senator Chris Van Hollen, who told him that “If FinCen has not already been in touch with that whistleblower, in my view, that’s gross negligence.”

Senator Sherrod Brown, the ranking member of the Committee, also addressed the issue in his opening statement, commenting as follows:

“This weekend we got a reminder of how important these issues are, courtesy of reporting by The New York Times that money laundering specialists working for Deutsche Bank had repeatedly recommended the filing of suspicious activity reports on transactions by President Trump’s and Jared Kushner’s organizations, including transactions with actors overseas.

“But those experts were over-ruled by senior Private Wealth Division officials. Even state regulators or House Financial Services Committee subpoenas to Deutsche Bank can’t get at suspicious activity reports that are never filed – that are effectively quashed within the bank and never conveyed to the experts at FinCEN in the Treasury Department and the financial watchdogs that are supposed to assess these transactions.

“And compliance officials described a pattern at Deutsche of efforts like that to reject SAR filings for lucrative clients. We need to get to the bottom of what happened here. Everyone has to follow anti-money laundering laws and rules – you don’t get an exemption if you have a rich and powerful client. And we have to hold financial institutions accountable if they break the rules. I’ve written to Deutsche Bank’s CEO making that clear, and demanding answers.”

Brown and Van Hollen earlier had released a letter they had sent to Christian Sewing, the CEO of Deutsche Bank, on the matter of the report in the Times. Among the numerous questions it demanded answers to was this: “Who were the Private Wealth Management or other bank decision makers involved in these decisions?”

David Enrich, the author of the most recent article at the New York Times, had written an article in March of this year identifying Rosemary Vrablic as the Private Banker at Deutsche Bank to both Trump and Kushner. She is considered one of the most powerful Private Bankers in New York City. Clearly, the Senators wanted to know if a Private Banker could kill a Federally-mandated suspicious activity report for a politically-connected client.

The Trump bullying effect appears to be causing yet another disfigurement of government: Members of Congress seem to be afraid to show up and do their job at the Congressional Committees on which they sit out of fear of saying something that will earn the wrath of the President.

Money laundering through global banks, including those on Wall Street, is one of the greatest threats to the national security of the United States since it can be used to finance all sorts of illicit activity from bribes to public officials, drug dealing, terrorist financing and the like. Despite the critical nature of this hearing on Tuesday, 11 of the 12 Republican members who sit on the Senate Banking panel didn’t show up for the hearing. Senator Mike Crapo, the Republican Chairman of the Committee, and Senator Patrick Toomey, were the only two Republicans to attend. The following Republican Senators who sit on the Committee were missing in action: Richard Shelby, Tim Scott, Ben Sasse, Tom Cotton, Mike Rounds, David Purdue, Thom Tillis, John Kennedy, Martha McSally, Jerry Moran and Kevin Cramer.

That lack of turnout by Republicans contrasted against the Democratic Senators on the Committee who did show up to ask engaging questions of the panel’s witnesses: Sherrod Brown, Jack Reed, Mark Warner, Chris Van Hollen, Doug Jones and Kyrsten Sinema.

The other two witnesses who testified at Tuesday’s hearing were Steven D’Antuono, Section Chief, Financial Crimes Section of the Federal Bureau of Investigation and Grovetta Gardineer, Senior Deputy Comptroller for Bank Supervision Policy at the Office of the Comptroller of the Currency. (Their testimony is available here and here, respectively.)

When the history books finally look back on this era from an enlightened perspective, they will surely expend an enormous amount of ink examining how so few within the Republican Party had the courage and love of their country to speak out when faced with an insurmountable mountain of evidence of corruption.

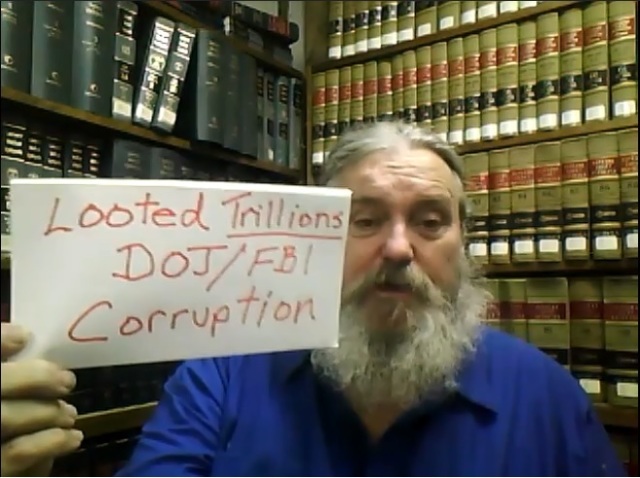

As Banksters WALTZ OFF WITH TRILLIONS https://youtu.be/FTnRbLBOIe8

Dear Jimmy Dozier GO TO HELL and take Marcus Winberry and NELDA BLAIR with You https://americalooted.wordpress.com/magical-fantastic-texas-banksters/

Fake Records Fake Papers LOOTED Trillions Dear OIG FHFA

The Worst Financial Looting in Human History

https://toxiczombiedevelopments.wordpress.com/about/

The EXTREMELY WELL FINANCED ORGY

The VANISHING OF TRILLIONS

By David Enrich

JACKSONVILLE, Fla.

Her superiors told her to stop raising questions, according to Ms. McFadden and the two former managers.

After taking her complaint to the human resources department, Ms. McFadden was transferred to another division. She was terminated in April 2018. The bank told her that she was not processing enough transactions.

See KAT WOOLFORD Judson Witham

Texas Land Frauds Judson Witham

The Largest Whitewash and Cover Up in History

America Looted Stupid

This Site Exists for TRILLIONS of Reasons …. JBW

The GREAT TEXAS BANK JOB SERIES …. The Largest Financial Looting in the History of the Earth

EXCELLENT WAY TO ACQUIRE ALL THAT COLLATERAL FOR PENNIES ON THE DOLLAR

Inexpensive Crappy GUARANTEED to go to Foreclosure Loans

EXCELLENT WAY TO ACQUIRE ALL THAT COLLATERAL FOR PENNIES ON THE DOLLAR

Damned Government Criminals

Describes fraud and liers loans in the economic crisis.

http://usawatchdog.com/jp-morgans-frauds-are-epicunprecedented-in-world-history-william–black/ Professor William Black is a …

http://www.DemocracyNow.org – Democracy Now! broadcasts on the road from Kansas City, Missouri, today. Amy Goodman interviews …

William Black Tells the Ugly Truth! – New Economic PerspectivesNew ...

Banksters – William Black tells the real truth – ABC Bullion

William Black Tells The Truth On Lehman’s Failure: “A Story In Large …

DRAIN THE SWAMP Fire Sessions

Constitutional Crisis AMERICA LOOTED

The Largest Crime Spree EVER https://www.google.com/search?source=hp&ei=NR2AW5uzMNKctAWBrJ6QCA&q=for…

Mr. Lars Hansen, Inspector General FHFA

Attention: Office of Investigations – HOTLINE

400 7th Street, SW

Washington, DC 20219

Banks and S&Ls Faked Insolvencies BANK FRAUDS Apt and Condo SCHEMES

|

1:33 PM (10 minutes ago) |

|

||

|

||||

Dear Mr. Lars Hansen, Inspector General FHFA

Attention: Office of Investigations – HOTLINE

400 7th Street, SW

Washington, DC 20219

As You have stated for Your Search Warrant posted at https://si.wsj.net/public/resources/documents/MorganApplicationforaSearchWarrant08152018b.pdf?mod=article_inline

It comes sharply into focus that FALSIFIED Documents and Records are the Heart of these FRAUD RACKETS employed to Pocket Hundreds of Billions.

The Robert C. Morgan Matters in Pittsburgh are also HEAVILY ongoing in Berks County and Reading PA with a number of Apartment Complex Companies There

Yes Reading PA has some very serious problems with Apartment Complex Financing and HUD Lending. I am at this time KEEPING THOSE Matters Guarded as I believe it’s Far Far Larger than the ROBERT MORGAN MATTERS

My Records and Assertions are in the Records of the 334th State District Court in Harris County as well as AD NAUSEA on Record with News Media and DOJ

Witham vs. Western Banks (FDIC) 86-17930 Harris County

COOKING THE BOOKS and FAKING LOTS OF RECORDS this is precisely what went down in HOUSTON TEXAS with Western Banks and Many Many Many OTHERS

Bob Morgan’s son, nephew suspected of wire and bank fraud

May 15, 2018 – Affidavit: 2 of Bob Morgan’s relatives suspected of wire and bank fraud … and created the false impression that apartments were occupied by …

Federal agent alleges fraud by two connected to Robert Morgan – The …

May 16, 2018 – Federal prosecutors have not accused developer Robert Morgan of … In one apartmentbuilding, the document alleges, they turned on radios in …

Morgan relatives among 4 indicted in $167M mortgage fraud scheme …

May 22, 2018 – Kevin Morgan is charged with conspiracy to commit wire fraud and bank … worth $167.5 million for apartment complexes in Buffalo and other cities. … Much more to examine, U.S. attorney says of Robert Morgan’s company.

U.S. Pursues One of the Biggest Mortgage-Fraud Probes Since the …

Aug 15, 2018 – One owner of properties investigators reviewed is Robert C. Morgan, the founder of a suburban Rochester, N.Y.-based apartment development …

Rochester developer’s son, nephew charged with bank fraud; includes …

May 23, 2018 – Rugby Square Apartments on Dorchester Avenue in Syracuse are among the real estate holdings of Rochester developer Robert Morgan.

Fayetteville reverses decision to pull Rt. 5 apartment-retail proposal …

Jun 28, 2018 – The son and nephew of Rochester developer Robert Morgan are … A federal grand jury issued indictments for bank and wire fraud against:.

Robert C Morgan | Mortgage-Backed Securities – The Real Deal

6 days ago – Federal agencies undertake largest mortgage fraud investigation since … On the ground, the alleged fraud involved dressing up apartments to …

Why federal investigators are focusing on ‘rent rolls’ from Robert …

Nov 5, 2017 – Rent rolls are an apartment complex’s list of tenants, their rents and related information. … In a report on mortgage fraud issued at the start of this decade, the … No one has told The News thatMorgan’s companies inflated their …

Federal probe focuses on apartment mortgage fraud: WSJ – Arbor …

7 days ago – The indictments made fraud-conspiracy charges against Todd Morgan and Kevin Morgan, a son and nephew of Robert Morgan, and charged …