The Murder of Due Process and Equal Protection of the Laws

An Underhanded SHITTY PLOT to steal Constitutional Rights from Americans

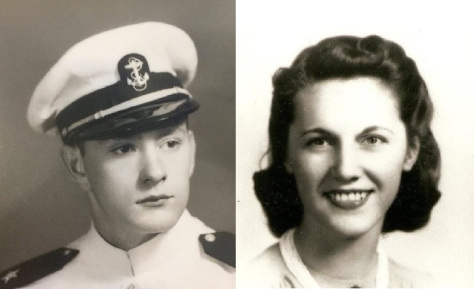

For Clifford and Anita Witham – JBW

Murdering the Fact Finders

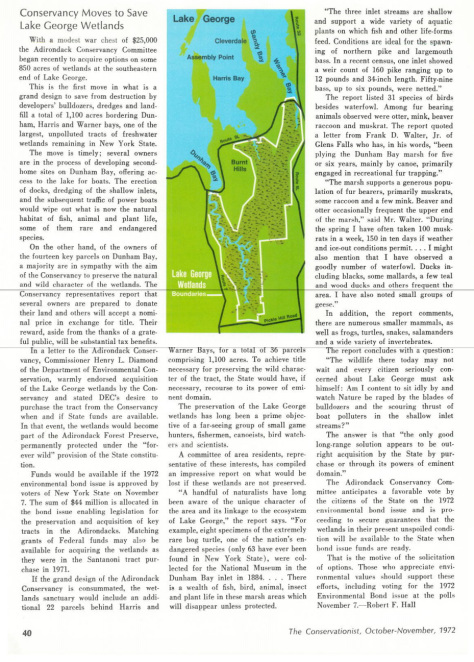

Lake George NY Hide the Pee and Hide the Pooh To | The theadirondacksconspiracy.wordpress.com/1850-2

The Vast Hidden History of Operating the Mill Pond Lake George, NY Part of the Continuing Series The Lake George Pinhole Mysteries See Lake George, THE FACTS Not the Fiction NYS DEC Controls the Lake since 1957 NYS DEC Controls the Lake since 1957 The State’s ICE and WATER Dumping destroyed the Witham Marina EVERY …

The Murder of Constitutional Rights in America

The SHITTIEST SAGA in the History of New York and Vermont …. THE SHITTIEST

The Correct and Proper Standards when Your Constitutional Rights are involved

SEE The PINHOLE IN THE BATHTUB MAFIA’S

GIANT BATHTUB RACKETEERING HERE

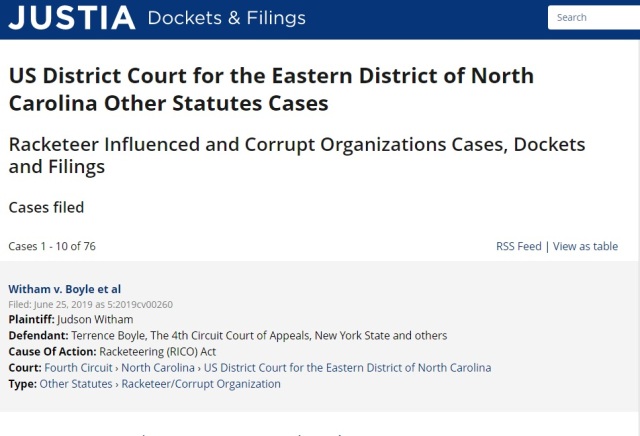

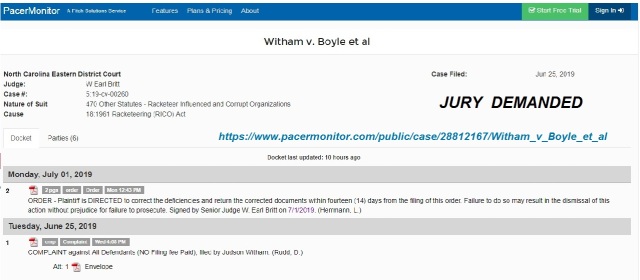

https://www.pacermonitor.com/public/case/28812167/Witham_v_Boyle_et_al

The LOW DOWN “DIRTY POOP” ON

LAKE GEORGE NEW YORK

United States District Court

Raleigh North Carolina

Judson Witham ) FRCP 8 FRCP 9 Improper Use

Vs ) Complaint for Denial Civil Rights

U.S. District Court )

Judge Terrence Boyle ) RICO Conspiracy and Fraud

The 4th Circuit Court of Appeals )

US Supreme Court )

New York State )

International Paper Corp. Et Al ) Case No _____________________

I

Plaintiff’s Original Complaint

NXIVM CULT US District Courts , US Supreme NXIVM Court of Fraud and Slavery

MURDER of Due Process and Equal Protection Deprivations

Now Comes Judson Witham proceeding In Forma Pauperis and will show FACTUALLY that the BRAND NEW, CHANGED and REWRITTEN “Heightened” Pleading Standards are a FRAUD created to impose NXIVM Cult Slavery on the Serfs, Indentured Servants, Slaves of the USA Inc. and the US Federal Reserve Banks. The BRAND NEW REWRITTEN “ Heightened “ Pleading Standards are Tyranical, Totalitarian , Oppressive, Unconstitutional NAZI Garbage.

- The imposition of the NEW / REWRITTEN Pleading Standards of the US

Courts are simply UNCONSCIONABLE, UNAMERICAN, UNCONSTITUTIONAL and ILLEGAL. Judge Boyle Court Stripped Plaintiff with Prevarications and Deception, UNTRUTHS.

- The proper pleading standards of FRCP 8 and FRCP 9 have been BASTARDIZED and CORRUPTED by the NXIVM Cult of Judges that have REWRITTEN and IMPOSED the Brand NEW , Re Written Standards.

3. The choice between or among plausible inferences or scenarios is one for the fact finder …. NOT The Judges

The Proper Standard …… Anderson News, L.L.C. v. Am. Media, Inc., 2012 U.S. App. LEXIS 6715 (2d Cir. Apr. 3, 2012). The Second Circuit held “because plausibility is a standard lower than probability, a given set of actions may well be subject to diverging interpretations, each of which is plausible. The choice between or among plausible inferences or scenarios is one for the fact finder . . . A court ruling on a Rule 12(b)(6) motion may not properly dismiss a complaint that states a plausible version of the events merely because the court finds a different version more plausible.” Thus, if there are two plausible interpretations of the alleged facts, then the complaint cannot be dismissed.

- The Proper Standards of FRCP 8 and FRCP 9

“[p]ro se complaints are to be held to less stringent standards…and should therefore be liberally construed, ” the Court is unable to state that the cause of action is clearly frivolous. Williams v. Curtin, 631 F.3d 380, 383 (6th Cir. 2011) (quoting Martin v. Overton, 391 F.3d 710, 712 (6th Cir. 2004)) (original quotation marks omitted).

- In 1957, the Supreme Court ruled that, under the Federal Rules of Civil Procedure, “a complaint should not be dismissed for failure to state a claim unless it appears beyond doubt that the plaintiff can prove no set of facts in support of his claim which would entitle him to relief.” Conley v. Gibson, 355 U.S. 41, 45-46 (1957). On May 21 .

“Accepting all well-pleaded allegations in the complaint as true, the Court ‘consider[s] the factual allegations in [the] complaint to determine if they plausibly suggest an entitlement to relief.

- Federal Rules of Civil Procedure (FRCP) Rule 9(b),1 THE BRAND NEW – REWRITTEN ” Heightened Pleading Standards … sets too high a pleading standard for plaintiffs to meet may constitute a deprivation of a plaintiff’s due process rights under the Fourteenth Amendment. The information necessary to satisfy the standard— the circumstances underlying the claim, including the who, what, where, when, and how—may be impossible to obtain at the outset of a case. In the event that the court dismisses the complaint, the application of the Rule might prevent a recourse for which the substantive law allows. When justifications for heightened pleading are not fairly balanced with the burden on the plaintiff, courts should reject the application of the Rule in lieu of Rule 8 notice pleading. Due process of law under the Fifth and Fourteenth Amendments at the onset of pleadings should NOT be grounds to COURT STRIP Litigants.

The Proper Standards of FRCP 8 and FRCP 9

“[p]ro se complaints are to be held to less stringent standards…and should therefore be liberally construed,” and should not be dismissed when the Court is unable to state that the cause of action is clearly frivolous. Williams v. Curtin, 631 F.3d 380, 383 (6th Cir. 2011) (quoting Martin v. Overton, 391 F.3d 710, 712 (6th Cir. 2004)) (original quotation marks omitted).

In 1957, the Supreme Court ruled that, under the Federal Rules of Civil Procedure, “a complaint should not be dismissed for failure to state a claim unless it appears beyond doubt that the plaintiff can prove no set of facts in support of his claim which would entitle him to relief.” Conley v. Gibson, 355 U.S. 41, 45-46 (1957). On May 21 .

[PDF]RECOMMENDED FOR FULL-TEXT PUBLICATION Pursuant to …

www.ca6.uscourts.gov/opinions.pdf/12a0112p-06.pdf

the pleader is entitled to relief.” Fed. R. Civ. P. 8(a)(2); Gunasekera, 551 F.3d at 466 (quoting Erickson v. Pardus, 551 U.S. 89, 93-94 (2007)). We are ever mindful that pro se complaints are liberally construed and are held to less stringent standards than the formal pleadings prepared by attorneys. Williams v. Curtin, 631 F.3d 380, 383 …

REPORT AND

RECOMMENDATION

www.tnwd.uscourts.gov/JudgeBryant/opinions/1000.pdf

Hill v. Lappin, 630 F.3d 468, 470-71 (6th Cir. 2010). “Accepting all well-pleaded allegations in the complaint as true, the Court ‘consider[s] the factual allegations in [the] complaint to determine if they plausibly suggest an entitlement to relief.’” Williams v. Curtin, 631 F.3d 380, 383 (6th Cir. 2011) (quoting Iqbal, 556 U.S. at 681,

The New Federal Pleading Standards in the Post-Iqbal Era

www.abfjournal.com/articles/the-new-federal-pleading-standards-in-the-post…

The typical standard of pleading in federal cases has long been governed by Federal Rules of Civil Procedure 8 and 9. … that allows the court to draw the reasonable inference that the defendant is … show that insolvency during this period was plausible. 12 Citing In re Troll Communications, 13 the Caremerica I court held that the trustee …

[PDF]Supreme Court Rewrites Pleading

Requirements

www.scotusblog.com/archives/Sup Ct Rewrites Pleading Rules.pdf

In 1957, the Supreme Court ruled that, under the Federal Rules of Civil Procedure, “a complaint should not be dismissed for failure to state a claim unless it appears beyond doubt that the plaintiff can prove no set of facts in support of his claim which would entitle him to relief.” Conley Gibson, 355 U.S. 41, 45-46 (1957). On May 21 .

[PDF]Minor Disruption – Twombly and Iqbal Through the Rear …

www.dallasbar.org/sites/default/files/dba_twombly_7-12 PPT.pdf

Minor Disruption – Twombly and Iqbal Through the Rear View Mirror William Frank Carroll …Grounds for entitlement to relief under FRCP 8(a)(2) … The choice between or among plausible inferences or scenarios is one for the fact finder . . . A court ruling on a Rule

The Conspiracy to Murder Federal Civil Rule 8 in the …

americalooted.wordpress.com/the-murder-of-rule-8-in-the-federal-korts the federal pleading standard under Rule 8 of the Federal Rules of civil procedure. … each others’ areas gave rise to a plausible inference of conspiracy.4 The court discounted the direct allega- … legalconclusions resting on the prior allegations. …

II

REWRITTEN ….. BRAND NEW

The BRAND NEW STANDARDS are ILLEGAL.

The HOCUS POCUS OF MURDERING CIVIL RIGHTS In American Courts

COURT STRIPPING EXPLAINED

CIVIL PROCEDURE: Pleading a “Plausible” Claim in Federal

www.nlrg.com/legal-content/the-lawletter/bid/95672/CIVIL-PROCEDURE-Pleading-a… Oct 07, 2013 · The Lawletter Vol 38 No 7. Paul Ferrer, Senior Attorney, National Legal Research Group. Plaintiffs looking to survive an early motion to dismiss under Federal Rule of Civil Procedure 12(b)(6) must file a complaint that contains “sufficient factual matter, accepted as true, to ‘state a claim to relief that is plausible on its face.'”

Pleading Facts and Arguing Plausibility: Federal Pleading

www.jonesday.com/pleading_facts

The Twombly Court instead explained that Rule 8 of the Federal Rules of Civil Procedure requires that a complaint include facts (as distinct from legal “labels” and “conclusions”) … In either case, plaintiffs still must allege enough underlying facts to allow a plausible inference of liability in …

[PDF]

Whether The Heightened Pleading Requirements Of Twombly …

www.nysba.org/Sections/Commercial_Federal_Litigation/ComFed_Display_Tabs/..

A claim is facially plausible “when the plaintiff pleads factual content that allows the court to draw the reasonable inference that the defendant is liable for the misconduct alleged.” Id. at 1949. In Twombly, the Supreme Court stated, “Federal Rule of Civil Procedure 8(a)(2) requires

The Conspiracy to Murder Federal Civil Rule 8 in the …

americalooted.wordpress.com/the-murder-of-rule-8-in-the-federal-korts

The choice between or among plausible inferences or scenarios is one for the fact finder . . . A court ruling on a Rule … First, a court is to exclude pleadings which are legal conclusions;

- The Plausible Pleading Standards of Rule 8 and 9 have been UNLAWFULLY

KILLED By Fraud of the 4th Circuit and US Supreme NXVIM Cult. In the Witham case BRAND NEW STANDARDS were as well improperly employed to MURDER Witham’s Case against THE EMPIRE STATE and the INTERNATIONAL POWER and PAPER CORPORATION ( An Owner in part of the NOT VERY Federal Reserve)

- By means of intentional mischaracterization and SLIGHT OF HAND ….. Judge Boyle and the 4th Circuit Court of Appeal with the US Supreme Court using PREVARICATIONS employed COURT STRIPPING to deny to Witham His Constitutional Rights.

- The 4th Circuit Court and the 4th Circuit Appellate Court with the US

Supreme NXIVM Slavery Court ….. Applied the WRONG STANDARDS and

Lied on a Massive Scale about New Yorks Business in North Carolina.

III

New York State Conducts VAST Business in North Carolina Judge Terrance Boyle simply LIED ABOUT IT

https://www.bing.com/search?q=Interstate%20Compact%20New%20York%20No

rth%20Carolina%20&qs=ds&form=QBRE

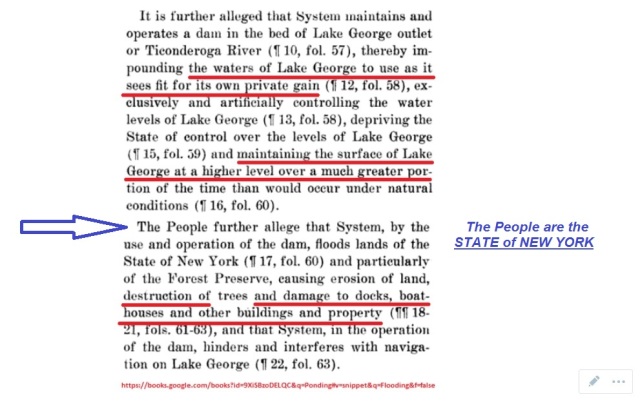

- The State of New York with International Power and Paper Corporation intentionally with scienter have for DECADES used the Lake Water of Lake George to harness the Horsepower of the Lake. The Lake George MILL POND is a well settled matter of Common Public Knowledge. Immense Vast Federal State and Academic Records, Judicial Records, Media Reports establish the MILL POND OPERATIONS on Lake George as a FACT. See The Worldwide Web for ENDLESS Evidence and Proof The Government Records, Scholastic Materials, Scientific Materials and Judicial Records, Media Reports are Irrefutable and Conclusive.

SEE DETAILS AT ….

https://www.bing.com/search?q=Lake%20George%20a%20Mill%20Pond%20%2

0Flushing%20Sewage%20Leachate&qs=ds&form=QBE

- The ICE PACK and Water Levels on Lake George are controlled by a WHOLLY INADEQUATE completely totally deficient Spillway System …. Specially designed, engineered and installed to SERVE the Interests of the POWER and PAPER Company as well as the Pecuniary Gains of the EMPIRE STATE.

- Clifford and Anita Witham and the Witham Family’s Marina was repeatedly DESTROYED by LAKE ICE and the WHOLLY INADEQUATE Dam #230 and the Draw down and Lake Ice Manipulations caused by the CONTINUING NUISANCE operated by New York State DAM # 230.

See …..

National Dam Safety Program. Lake George Outlet Dam www.researchgate.net/publication/235131124_National_Dam_Safety_Program_La ke… Download Citation on ResearchGate | National Dam Safety Program. Lake George Outlet Dam(Inventory Number NY 230), Lake Champlain River Basin, …

Lake George NY Hide the Pee and Hide the Pooh To | The … theadirondacksconspiracy.wordpress.com/1850-

The State’s ICE and WATER Dumping destroyed the Witham Marina EVERY YEAR so the State could FLUSH all the Poop and Chemicals and Mill Wastes further and further and further into Lake Champlain. The Winter Time Ice Manipulations wiped Clifford and Anita Witham’s Marina out, over and over and over and over and over again.

Poisoning Lake George – The Flooding Toxins and Sewage …

theadirondacksconspiracy.wordpress.com/poisoning-lake-george-flooding-toxins…

Lake George Outlet Dam (Inventory Number NY 230), Lake Champlain River Basin, … Personal Author(s) : Stetson,John B. DAM “A” on Lake George at Weedville is 54% incapable of controlling LakeLevels. There has been a FORTUNE MADE from Winter …

DTIC ADA090941: National Dam Safety Program. Lake George …

archive.org/details/DTIC_ADA09091

DTIC ADA090941: National Dam Safety Program. Lake George Outlet Dam (Inventory Number NY 230), Lake Champlain River Basin, Essex County, New York. Phase I Inspection Report, Item Preview remove-circle Share or Embed This Item.

The Delusional Fantastical FREE Dam of Lake George NY and

theadirondacksconspiracy.wordpress.com/the-delusional-fantastical-free-dam-of…

environmentally flushing mill pond …. lake george ny . free dam my ass. … the release capacity at lake george ny at dam # 230 aka dam “a … lake george lake champlain sewage and toxins galore; lake george leachate the faked lake george records; lake george mill pond – …

Lake George Mill Pond – Pump and Dump for Millions | The …

theadirondacksconspiracy.wordpress.com/lake-george-mill-pond-pump-and-dump-for… Lake George Mill Pond – Pump and Dump for Millions. … Lake George Outlet

Dam(Inventory Number NY 230), Lake Champlain River Basin, Essex County, New York.Phase I Inspection Report. … Therefore, the spillway is assessed as inadequate according to the Corps of Engineers screening criteria. … Lake George NY Flushing the Leachate Poisoning …

Lake George Sewage Flushing – Page Profile – Spreely

www.spreely.com/page/LakeGeorgeFlusherGate/tab/2073

LAKE GEORGE NY – Dam # 230 EXPOSED Maybe the Darrin Fresh Water / RPI University with Lake George Association, POST STAR , Lake George Land Conservancy and the NYS DEC and Fund for L…

Lake George, famous for its clarity, is changing color …

poststar.com/news/local/lake-george-famous-for-its-clarity-is-changing-color/..

I grew up on the Witham Marina at Harris Bay. The Winter Time Lake Flushing is currently before the Courts of the United States. The Dam ” 230 ” AKA Dam “A” built by the Glens Falls Banks and

the … Author: WILL DOOLITTLE Will@Poststar.Com

Damned Truth LAKE GEORGE NY – Group Profile – Spreely

www.spreely.com/group/Dam230LakeGeorge

The DAMNED DAM Truth about Lake George This is the group view group. Spreely.com, The Social Network For Free People. No Censorship, No Shadow Bans, No BS. Speak Freely

Questions for Lake George and NY State Officials LGPC RPI ..

toxiczombiedevelopments.wordpress.com/questions-for-lake-george-ny-officials…

Winter Time LAKE FLUSHING …. How SNEAKY does it get for the UBER WEALTHY of LakeGeorgeNY. Dilution is the Solution to the SEWAGE in Lake George Lake Flushing LAKE GEORGENEW YORK. Dumping the LaChute River CRAP into Lake Champlain and beyond. From the Dam at Lake George. To the GIANT Shit Bed at Fort Ticonderoga

III.

The BRAND NEW REWRITTEN Unconstitutional

“Heightened Pleading Standards“

- New York State does huge amounts of Official Business with North Carolina and as well is a Domestic Situs for the International Power and Paper Company. New York State conducts VAST amounts of Official Business IN the 4th Circuit and North Carolina

- The EMPIRE STATE’s Interstate Compacts and the State of the Empire itself conducts all sorts of Commercial and Official Business in North Carolina in particular ADVERTISING Recreational and Outdoors Vacationing in the EMPIRE STATE. Financial Investments, Travel, Government Operations etc etc.

3. The Minimum State Contacts standards of International Shoe (International Power and Paper ) are ABUNDANTLY REAL and are enormously a fact and reality herein BUT Judge Boyle and the 4th Cir Appellate Court simply IGNORED Reality and Facts and by FRAUD glossed over and by DECREE and FIAT simply erroneously and without factual basis ….. Claimed the MINIMUM of the Minimum State Contacts do not exist …. EVEN THOUGH THAT IS UNTRUE and FALSE.

International Shoe Establishes Minimum Contacts Testconstitutionallawreporter.com/2017/09/13/international-shoe-establishes...

International Shoe Establishes Minimum Contacts Test. In International Shoe Co. v. State of Washington, 326 U.S. 310 (1945), the U.S. Supreme Court first established the minimum contacts testfor determining whether a corporation is subject to the jurisdiction of a state court. Under the

Court’s holding, the Constitution’s Due Process only requires…

Minimum Contacts and the International Shoe Case

www.legalteamusa.net/minimum-contacts-and-the-international-shoe-case

International Shoe and its progeny. In order to determine whether a state court will exercise jurisdiction over an out of state defendant, the court will employ a test known as the

“minimum contacts” test.

IV.

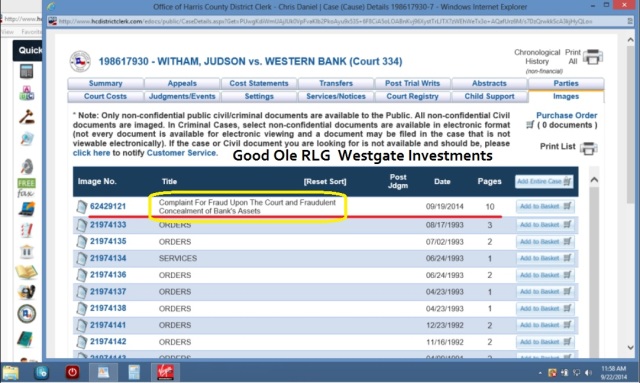

Witham Case dismissed by FRAUD …. Court Stripping Witham Concealing the

VAST POISONING of the Interstate Waters of the Lake Champlain Watershed.

- The Gargantuan Public Record of the IMMENSE Destruction of the International Fisheries and Public Water Source of the Richelieu River, The Saint Lawrence Seaway and Lake Champlain is Abundantly and Copiously Available to the People of Planet Earth. Only Judge Boyle and the 4th Circuit Courts and US Supreme NXIVM Court have sought to BURY theTruth , Bury the FACTS and Murder the Reality of the Sewage Flushing, Chemical Flushing and ICE PACK and Lake Water Debacle of the #230 Dam at the North End of Lake George.

See https://www.google.com/search?ei=UOIQXcWNDaGe_Qbs4rKoDA&q=Lake +Champlain+Fishery+Sewage+Pollution+Mill+Wastes+Lake+Poisoning&oq =Lake+Champlain+Fishery+Sewage+Pollution+Mill+Wastes+Lake+Poisoni ng&gs_l=psy-ab.12…0.0..1259…0.0..0.0.0…….0……gws-wiz.0a_wVSmUviA

- The Wholly deficient Spillways of #230 Dam and the WINTER TIME Lake Flushings on Lake George are a Matter of PUBLIC RECORD as well as DOCUMENTED by the US Supreme NXIVM Court of Fraud. The Lake Ice manipulations caused by the WHOLLY DEFICIENT NUISANCE DAM has for decades caused MASSIVE Private Property Damages on Lake George.

- The Continuing Damages and Continuing NUISANCE is still causing damages as Dam # 230 remains WHOLLY DEFICIENT and is operated to FLUSH the Lake and to Make MAXIMUM Profits for the State and the State’s Partners. COPIOUS INFORMATION is Publically available to show the FACTS associated with New York State’s destruction of the Interstate Fisheries on Lake Champlain.

See Yearly Flushing of Lake George, NY … WINTER TIME LAKE …

theadirondacksconspiracy.wordpress.com/yearly-flushing-of-lake-george-ny

YEARLY FLUSHING OF LAKE GEORGE, NY … WINTER TIME LAKE FLUSHING; THE FACTUAL HISTORICAL RECORD OF TOILET LAKE GEORGE and the decades of FLUSHING is no longer a SECRET …. The UGLY TRUTH is EXPOSED.

Dedicated to My Parents Mr. and Mrs. Swamp Fox. The Founders and Original Creators of the Harris Bay Marina at THE SWAMP

Lake Level | Lake George Park Commission

https://lgpc.ny.gov/lake-level

The Commission oversees the lake’s water level by tracking the lake’s surface … By using the discharge capacity to draw down the lake to accommodate spring… meansea level is established by Section 38 of the New York Navigation Law.

THE STATE OF NEW YORK’s Version

Lake George is a natural lake whose surface elevation has been raised slightly (perhaps 2-3 feet on average) by a dam constructed at the outlet in Ticonderoga along the La Chute River. The additional elevation of lake level created by the dam can be regulated to some extent by the dam’s discharge structures. By using the discharge capacity to draw down the lake to accommodate spring runoff and by limiting discharges at other times, people are able to keep the lake’s level, for the most part, within an annual range of about 12 to 16 inches. However, natural forces sometimes exceed human designs. Excessive precipitation and runoff can cause the lake to rise occasionally to undesirable levels. The limited discharge capacity of the outlet means that when the lake is too high it is slow to return to normal. Persistent dry weather and evaporation can cause lower than desired lake levels, as well.

……… New York State and the Lake George Park Commission should be NOTED ….. Dam #230 creates a LIMITED Discharge Capacity ( being 54% Way Way to Limited ) which creates the PINHOLE in the BATHTUB Conditions …….. See

https://www.bing.com/search q=Pinhole%20in%20a%20Bathtub%20%20Lake%20George &qs=ds&form=QBRE

Lake Level | Lake George Park Commission

The capacity has been likened to draining a bathtub through a pinhole. When water entering the lake exceeds the maximum rate that can be discharged, the lake rises. Each winter the lake is drawn down in anticipation of the spring snow melt

The PINHOLE IN THE BATHTUB according to The Lake George Park Commission that is. A FOIL Request has been made on more than one occasion to the State of New York regarding the WINTER TIME DRAW-DOWNS and the PINHOLE in The Bath Tub. https://www.bing.com/search?q=Pinehole%20Bathtub%20Lake%20George%20&qs=ds&form=QBRE

LAKE GEORGE FACTS – Separating Facts from Fiction

lootednation.wordpress.com/2017/06/29/lake-george-facts-separating-facts-from-fiction

The Giant Bathtub Scam Lake George NY The Pinhole EXPOSED

theadirondacksconspiracy.wordpress.com/the-giant-bath-tub-scam-lake-george-ny

The Inadequate Spillways of Lake George AKA Pinhole in the Bathtub; The Lake Flusher Evidence Mounts – LAKE GEORGE NY Exposed <—<<< The Lands of the Turtle Islanders SEIZED AKA Stolen; The MANY MANY MANY Flushes of Lake George NY; The PHYSICS of Directed Energy Weapons … Lake George Dam Destruction Forces & Water

The Delusional Fantastical FREE Dam of Lake George NY and ..

NOW the State has $150,000.00 FREE Dollars to Reconstruct the OLD Pinhole in the Bathtub and Build the BRAND NEW FREE Pinhole in the Bathtub which in 1980 is Inspected and Rated as 54% Wholly incapable of Proper Water Level Control on Lake George.

Images of pinhole in a bathtub lake george

See more images of pinhole in a bathtub lake george

LAKE GEORGE FACTS – Separating Facts from Fiction

lootednation.wordpress.com/…/29/lake-george-facts-separating-facts-from-fiction Jun 29, 2017 · The PINHOLE IN THE BATH TUB according to The Lake George Park Commission that is. A FOIL Request has been made on more than one occasion to the State of New York regarding the WINTER TIME DRAW-DOWNS and the PINHOLE in The Bath Tub.

Lake Level | Lake George Park Commission

The capacity has been likened to draining a bathtub through a pinhole. When water entering the lake exceeds the maximum rate that can be discharged, the lake rises. Each winter the lake is drawn down in anticipation of the spring snow melt.

Poisoning Lake George – The Flooding Toxins and Sewage

theadirondacksconspiracy.wordpress.com/poisoning-lake-george-flooding-toxins… Poisoning Lake George – The Flooding Toxins and Sewage; President Trump – Jeff Sessions- Judge Grant Dorfman – WELCOME TO THE SWAMP … Yearly Flushing of Lake George, NY …

WINTER TIME LAKE FLUSHING; Search for: Poisoning Lake George – The Flooding Toxins and Sewage

- New York Fills In Lake George · Lake George Fact · Lex Rex · Foil Demand New York State

Lake George NY Flushing the Leachate Poisoning Lake ..

Mar 08, 2017 · For decades the State of New York complained of Dock and Boat House, Island and Shoreline Damages caused by INTERNATIONAL PAPER CORPORATION. The shocking reality is New York State Conservation Department and EVCON / DEC with the Lake George Park Commission continue with the WINTER TIME…

V.

Generating POWER and Flushing Chemicals, Sewage and the DESTRUCTION of Marinas, Islands, Shoreline, Public and Private Property Destruction

The RUINATION of the International Fisheries and those of Interstate Lake Champlain FOR PROFIT

- The Vast Destruction of the Interstate Fisheries of Lake Champlain is

ABUNDANTLY Memorialized in Government, Scholastic and Public Media Sources on a GARGANTUAN SCALE See https://www.bing.com/search?q=Sewage%20Lake%20George%20Lake%20Champ lain&qs=ds&form=QBE

Poisoning Lake George – The Flooding Toxins and Sewage

… https://theadirondacksconspiracy.wordpress.com/poisoning-lake-george-flooding-toxins-and-sewage/ … – The Lake George Association meeting today at the Lake George Club requested the State Conservation Department to take steps to obtain legal relief in the matter of Lake George water levels. Many Many Billions in Damages to Lake George and Lake Champlain in THE ADIRONDACK PARK …..

- New York Fills In Lake George Lake George Fact · Lex Rex · Foil Demand New York State

700,000 gallons of sewage dumped into Lake Champlain

https://www.mychamplainvalley.com/news/700000-gallons-of-sewage-dumped-into-lake-champlain/

This past weekend nearly 700,000 gallons of partially treated sewage was released into Lake Champlain and city officials are calling it a…

- Author: Haley Bouley

Images of sewage lake george lake champlain

bing.com/images See more images of sewage lake george lake champlain

Sewer woes again close iconic Lake George beach – Times Union

www.timesunion.com/allwcm/article/Sewer-woes-again-close-iconic-Lake-George…

Jun 21, 2017 · DEC officials met Tuesday to discuss the sewage investigation with representatives from Lake George town and village, the Lake George Park Commission, Lake Champlain/Lake GeorgeRegional Planning …

- Author: Brian Nearing

VERMONT ERUPTS over Billions in Taxpayer Clean Up Costs …

theadirondacksconspiracy.wordpress.com/vermont-erupts-over-billions-in…

VERMONT ERUPTS over Billions in Taxpayer Clean Up Costs …. Lake Champlain FUBAR. The State of New York and Warren County, Queensbury and Lake George CAN NO LOGER HIDE THE DAM FACTS Just The DAM FACTS

-

Lake Champlain cleanup could exceed $1 billion

Jan 17, 2017 · Lake Champlain cleanup could exceed $1 billion. Governor says Vermont is committed to cleaning up Lake Champlain and hoped it could be done without raising fees or taxes.

-

Author: WILSON RING

-

-

Editorial: Lake communities need to get a handle on scope …

The taxpayers, ALL the taxpayers, have been paying over $400,000 a year towards invasive species efforts on Lake George The most damaging invasive specie on the Lake would be a lakefront owner …

-

Lake Champlain cleanup could exceed $1 billion

MONTPELIER – Gov. Phil Scott says the state remains committed to seeing Lake Champlain cleaned up, even though the total estimated price tag over the next 20 years could exceed $1 billion. The new …

-

New York State a very Shitty Record | Trillions Stolen …

The very wealthy Members of the Lake George Association and Charlie Tuttle along with the Coolidges, Woodburys and others from the Glens Falls Banks and the Village and Town of Ticonderoga have always known They with New York State itself was directly perpetrating and causing the damages to the DOCKS, ISLANDS, BULKHEADS and BOAT HOUSES.

-

Lawmakers look at fees, taxes to fund Lake Champlain …

Feb 24, 2017 · Lawmakers look at fees, taxes to fund Lake Champlain cleanup. The treasurer’s report identified a $62.4 million per year funding gap. Of that, $48.5 million must be invested in cleanup each year under a federal mandate. Another $13.86 million ought to be available for pollution …

-

Author: Mike Polhamus

-

-

On April 17th Taxpayers Will Pay To Clean Up After .

Apr 13, 2006 · Taxpayers now pay for all Superfund-led toxic cleanups, spending well over $1 billionannually to protect public health from the irresponsible business practices of polluting industries. As valuable public dollars are spent on these cleanups, polluting industries are enjoying a $4 million per day tax break courtesy of the American taxpayer.

State funding sewage projects along Lake Champlain …

www.adirondackexplorer.org/…/state-funding-sewage-projects-along-lake-champlain

Dec 27, 2018 · The Cuomo administration’s recent announcement of nearly $65 million of economic development funding for northern New York includes several million dollars for municipal sewage upgrades and other measures to help protect Lake Champlain and other Adirondack waters.

Follow the Money … The Oligarchs of Paper, Mill Toxins and …

lootednation.wordpress.com/follow-the-money-the-oligarchs-of-paper-on-lake…

The Oligarchs of Paper, Mill Toxins and Sewage on Lake George, NY … Millionaires Row What is amazing is the Organization of Bankers and Lawyers, Insurance Company, Chemical Titans and

the Government that have protected the GIANTS of the Paper Making Industries since the time of the American Revolution.

Lake George Sewage Flushing – Page Profile – Spreely

www.spreely.com/page/LakeGeorgeFlusherGate

The Massive Poisoning of Lake George and Lake Champlain This is the page view page. Spreely.com, The Social Network For Free People. No Censorship, No Shadow Bans, No BS.

Speak

Freely

State grants to help address Lake George sewage

www.adirondackexplorer.org/…/state-grants-to-help-address-lake-george-sewage

Dec 31, 2018 · Another approval intended to help protect Lake George from sewage was more than $650,000 for the Town of Lake George to consolidate two wastewater pump stations, upgrade one and install pipes. For the Town of Hague, the department approved $230,000 to install new control systems at two wastewater pump stations.

- Enormous numbers Public Records reveal the Interstate Commerce of the Intestate Fisheries have been devastated by the SEPTIC TANK Operations of the Lake George Lake Champlain Watershed as herein revealed. BUT FOR the Damned Dams and the SEWAGE and CHEMICALS Dumping FOR PROFITS the Interstate Commerce of the Fisheries would NOT HAVE BEEN DESTROYED. See RICO VIOLATIONS Interstate Commerce.

3. The ICE and WATER Fluctuations on Lake George caused by POWER

GENERATION and FLUSHING Lake George with the PURPOSEFUL and

INADEQUATE DAM #230 directly caused the Destruction of the Witham Family

Marina and Islands and Docks, Shoreline, Boathouses, and Bulkheads all over

Lake George for DECADES. The so called “ Winter Time Drawdown “ using the

Pinhole in the Bathtub …. ALL being Recklessly and Intentionally engaged in to

BENEFIT The International Power and Paper Corporation and the Pecuinary Interests of NEW YORK THE EMPIRE.

- The Intentional Mill Pond Operations of New York State and the International Power Corporation directly destroyed the Witham Marina and served to destroy the Interstate Fisheries and Public Water Supplies of Lake Champlain.

Wherefore Premises Considered, Witham proceeding In Forma Pauperis

Demands that Judge Boyle and the 4th Circuit Courts be ORDERED to apply the

ORIGINAL and CORRECT Standards of FRCP 8 and FRCP 9 and as follows,

- That New York State Return the 600 Acre Witham Marina to the Witham

Family,

2. That International Power and Paper with New York State be Individually and Jointly held to answer for the LAKE ( Mill Pond Operations ) and to Correct and Upgrade the PINHOLE SPILLWAYS on Lake George.

3. That New York State and International Power and Paper pay to the Witham Family ACTUAL DAMAGES for the Destruction of the and the loss of the 600 Acre Witham Marina.

4. That New York State and International Paper Power and Paper pay to the Witham Family $ 200 Million “ Federal Reserve Notes “ to the Withams for the Damages Cause by thier SEWAGE FLUSHING and LAKE ICE , Mill Pond Operations using Dam # 230.

5. That the Courts of the United States be held to answer and to PROPERLY observe and Properly Apply the FRCP 8 and FRCP 9 as originally See CIVIL PROCEDURE: Pleading a “Plausible” Claim in Federal

Oct 07, 2013 · The Lawletter Vol 38 No 7. Paul Ferrer, Senior Attorney, National Legal

Research Group. Plaintiffs looking to survive an early motion to dismiss under Federal Rule of Civil Procedure 12(b)(6) must file a complaint that contains “sufficient factual matter, accepted as true, to ‘state a claim to relief that is plausible on its face.‘”

[PDF] Specificity or Dismissal: The Improper Extension of Rule 9

scholarship.law.wm.edu/cgi/viewcontent.cgi?article=1699&context=wmborj

Federal Rules of Civil Procedure (FRCP) Rule 9(b),1 applicable to claims of “fraud or mistake,” sets too high a pleading standard for plaintiffs to meet when ex-tended to negligent misrepresentation claims. Rule 9(b), or “heightened pleading,” 2 for this line of claims may constitute a …

6. Judge Boyle and the 4th Circuit Court of Appeals employing DECEPTION and

FRAUD and applying ABSOLUTELY FALSE Legal Excuses and Prevarications,

COURT STRIPPED PLAINTIFF for His Human Rights and Constitutional Rights both

State Constitutional and Federal Constitutional Rights absolutely Denied and Stripped

…… By Fraud ….. NO IMMUNITY ATTACHES to Federal Judicial Officers for

FRAUDULENT Conduct

JUDSON WITHAM, Plaintiff, v. NEW YORK STATE, et al., Defendants.

United States District Court, E.D. North Carolina, Western Division.

August 17, 2018.

Editors Note

Applicable Law: 18 U.S.C. § 1961

Cause: 18 U.S.C. § 1961 Racketeering (RICO) Act Nature of Suit: 470 Racketeer / Corrupt Organization

Source:

PACER

Attorney(s) appearing for the

Case Judson Witham, Plaintiff, pro se.

ORDER

TERRENCE W. BOYLE, District Judge.

This cause comes before the Court on plaintiffs prose motion to vacate [DE 20] this Court’s previous order dismissing his case. [DE 6].

Plaintiff, proceeding pro se, originally filed his complaint on April 10, 2017. [DE 1]. This Court dismissed his case on May 31, 2017, finding that he had failed to satisfy the minimum notice standard articulated in Ashcroft v. Iqbal, 556 U.S. 662 (2009), Note this claim is NOT TRUTHFUL NOT FACTUAL and is a TOTAL PREVARICATION. and that the Court lacked personal jurisdiction over the defendants. [DE 6]. NOTE NEW YORK STATE and INTERNATIONAL POWER AND PAPER are abundantly

conducting Business in the 4th Circuit . Plaintiffs appeal was dismissed by the

Fourth Circuit [DE 16] and the Supreme Court denied his petition for writ of certiorari [DE 19]. Plaintiff has now moved to vacate the dismissal pursuant to Federal Rule of

Civil Procedure 60(b).

Federal Rule of Civil Procedure 60(b) provides for several grounds for relief from a final judgment, order, or proceeding, including, (1) mistake, inadvertence, surprise, or excusable neglect; (2) newly discovered evidence that, with reasonable diligence, could not have been discovered in time to move for a new trial under Rule 59(b); and

(3) fraud, misrepresentation, or misconduct by an opposing party. Fed. R. Civ. P.

60(b)(1)-(3).

Plaintiff does not establish that relief pursuant to Rule 60(b) is merited here. His motion is not pursuant to any of the above grounds.1 The Court construes prose pleadings liberally, Erickson v. Pardus, 551 U.S. 89, 94 (2007), but the contents of plaintiffs motion are those claims already considered and rejected by this Court when it entered its final judgment. [DE 6]. Therefore, nothing in the motion supports setting that judgment aside.

For the foregoing reasons, plaintiffs motion to vacate this Court’s order [DE 20] is DENIED.

SO

ORDERED.

Foot Notes

- Plaintiff’s motion does contain the word `fraudulent,’ but is still a rehashing of his original arguments. And, as his case was dismissed prior any defendant being served, alleging an opposing party committed fraud, misrepresentation or misconduct is not possible.

Note ….. Judge Boyle’s Claims are ABSOLUTE UNTRUTH and the Standards

Applied in this case are COMPLETELY Unconstitutional. The NEW /

REWRITTEN Pleading Standards are TOTAL NXIVM Court Slavery Cult MALARKY and Intentionally CONTRIVED imposed for the purpose of denying Civil Rights to Plaintiff Witham and His Family.

The FACTS of the Lake George Lake Champlain DESTRUCTION of the Lake

George, Lake Champlain Watershed is a matter of WELL KNOWN PUBLICLY RECOGNISED FACTS

Lake George NY Hide the Pee and Hide the Pooh To | The …

https://theadirondacksconspiracy.wordpress.com/1850-2/

The State’s ICE and WATER Dumping destroyed the Witham Marina EVERY YEAR so the State could FLUSH all the Poop and Chemicals and Mill Wastes further and further and further into Lake Champlain. The Winter Time Ice Manipulations wiped Clifford and Anita Witham’s Marina out, over and over and over and over and over again.

Poisoning Lake George – The Flooding Toxins and Sewage

https://theadirondacksconspiracy.wordpress.com/poisoning-lake-george-flooding-toxins-and-sewage/

Poisoning Lake George – The Flooding Toxins and Sewage Part of the Continuing Series The Lake George Pinhole Mysteries AUTHOR’S NOTE : The Intentional Inadequacy of the Spillway

GREATLY Profits the State and Hydro Power Company.

- New York Fills In Lake George · Lake George Fact · Lex Rex · Foil Demand New York State

Lake George Lake Champlain SEWAGE and TOXINS Galore

https://theadirondacksconspiracy.wordpress.com/lake-george-lake-champlain-sewage-and-toxins-galore/

1500 Acres of Sewage and Toxic Chemicals Do a Word Search for SLUDGE Here The ANNUAL PINHOLE FLUSHING OF LAKE GEORGE YES ABSOLUTELY LAKE GEORGE GETS FLUSHED OF IT’S POLLUTION ESPECIALLY DURING WINTER TIME TOILET

- New York Fills In Lake George · Foil Demand New York State · Complete Lake George History

Lake George New York THE MILL POND SAGA | Trillions Looted

https://lootednation.wordpress.com/lake-george-new-york-the-mill-pond-saga/

Lake George New York THE MILL POND SAGA. … Have You any information on such practices and in particular regarding the effects on Lake George, NY and Lake Champlain where the flushing from Lake George is sent. … It should be noted that Lake George is referred to as a Bath Tub in the Agency’s Description of the Winter Time Drawdowns They …

The Damned Dam of Lake George, NY … POISONING Lake

www.youtube.com/watch?v=znM8tgBOZro

Mar 29, 2018 · Flushing the TURDS of lake George GOES to the US Supreme Court WE ARE ON THE DOCKET. … The Damned Dam of Lake George, NY … POISONING Lake Champlain Jud Witham. … SWAMP DRAINING TIME ABA …

[PDF] Why Lake Drawdowns Are Conducted – New Hampshire

www.des.nh.gov/organization/commissioner/pip/factsheets/db/documents/db-16.pdf Why Lake Drawdowns Are Conducted . Lake level drawdowns are conducted at many New Hampshire lakes for a variety of reasons. The purposes may include protection of the shoreline from the erosion effects of high water, control of aquatic weeds near the shore, reducing the adverse effects of winter ice on the shoreline and

Lake George NY Flushing the Leachate Poisoning Lake …

Lake George NY Flushing the Leachate Poisoning Lake Champlain. … The shocking reality is New York State Conservation Department and EVCON / DEC with the Lake George Park Commission continue with the WINTER TIME Practice. Knowing full well the 46% Capacity of the Wholly inadequate Dam “A” Vimeo …

Lake George Sewage Flushing – Page Profile – Spreely

www.spreely.com/page/LakeGeorgeFlusherGate

The Massive Poisoning of Lake George and Lake Champlain This is the page view page. Spreely.com, The Social Network For Free People. No Censorship, No Shadow Bans, No BS. Speak Freely

- The Legal and Factual Conclusions of Judge Boyle, His Clerks, the Appellate Court of the 4th Circuit and the ABSURD TRASHING of the Papers at the US Supreme Court in the Witham case is JUDICIAL FRAUD of an Unprecedented Nature. The Law and The Facts mean NOTHING to the NXIVM Cult Slavery of the 4th Circuit Courts and the US Supreme NXIVM Cult Slavery of these PLANTATION MASTERS. Succintly Stated Judge Boyle and the 4th Circuit’s Prevarications are ABSOLUTELY Incorrect and NOT Factual.

- Declaratory Relief for the Improper Application of the NEWLY WRITTEN, Brand New Rewritten Standards of FRCP 8 and FRCP 9 should be imposed on the Courts of the United States to STOP the Denial of Civil Rights, Equal Protection and Due Process Rights afforded to the People’s of the United States under the UNIVERSAL DECLARATION on Human Rights and the States and United States Constitutions.

- Witham demands Return of the Witham Marina Property. 600 Acres

- Witham Demands $25 Actual Damages for destruction of the Witham Marina.

5. Witham Demands $100 Milion for Intentional Infliction of Physical and Emotional Distress.

6. Witham Demands $200 Million for PUNITIVE DAMAGES from the Courts herein involved and the State of New York, International Paper Company …. Joint and Several Liability Standards Apply.

- Witham Demands that the Courts of the United States be directed to ABANDON the New and Rewritten so called “ Heightened Pleading Standards “ and by Judicial Decree and Order return to and apply the ORIGINAL PROPER STANDARDS set forth by FRCP 7 FRCP 8 and FRCP 9. See FRCP 8 and FRCP 9

Respectfully Submitted

Judson Witham

Certificate of Service

This is to certify that this Complaint for Constitutional Violations , deprivations of Civil

Rights against TERRENCE W. BOYLE, District Judge and the Courts and Appellate Courts of the 4th Circuit Courts of Appeals have been served upon them by EMail and US Mail on this the day of June 2019

Judge Terrence W. Boyle US District

Courts, North Carolina Clerk of the US

District Court 310 New Bern Ave Ste 1, Raleigh, NC 27601

US Court of Appeals 4th Circuit 1100 E Main St Ste 501, Richmond, VA 23219

International Paper Company

201 E 28th St, Charlotte, NC 28206

Attorney General

New York State

Public Services & Government

28 Liberty St, New York, NY 10005

Phone: (212)

416-8000

Make Lake George Great Again ….. An INDEPENDENCE Message

|

8:46 AM (1 hour ago) |

|

||

|

||||

When Federal Judges MAKE UP STORIES and FILE FAKED and FALSE Court Records

Witham v. Boyle et al 5:2019cv00260 | US District Court for the Eastern ..

Racketeer Influenced and Corrupt Organizations … – Justia Dockets

Racketeer Influenced and Corrupt Organizations … – Justia Dockets

Racketeer Influenced and Corrupt Organizations … – Justia Dockets

Witham v. Boyle et al. Filed: June 25, 2019 as 5:2019cv00260. Plaintiff: Judson Witham. Defendant: Terrence Boyle, The 4th Circuit Court of Appeals, New York …

-

The Poisoning of Lake Champlain ….. 800 TONS Daily for …

Aug 10, 2015 · The Poisoning of Lake Champlain ….. 800 TONS Daily for Decades and the Lake GeorgePINHOLE Mafia. August 10, … BEFORE THE POISONING of Lake Champlain … They love Lake GeorgeBUT Champlain NOT SO MUCH ….. The Shitty …

-

Poisoning Lake George – The Flooding Toxins and Sewage …

Poisoning Lake George – The Flooding Toxins and Sewage Part of the Continuing Series The Lake George Pinhole Mysteries AUTHOR’S NOTE : The Intentional Inadequacy of the Spillway GREATLY Profits the State and Hydro Power Company.

-

The Damned Dam of Lake George, NY … POISONING Lake …

12:39Mar 29, 2018 · Flushing the TURDS of lake George GOES to the US Supreme Court WE ARE ON THE DOCKET. Skip navigation … The Damned Dam of Lake George, NY … POISONING Lake Champlain Jud Witham. Loading…

-

Author: Jud Witham

-

-

Questions for Lake George and NY State Officials LGPC RPI …

Like the Hudson River Lake George, the Champlain Canal continually spread sewage , chemicals and wastes. Lake Champlain is a huge mess as is the Hudson River and OTHERS. The Poisoning of Lake Champlain ….. 800 TONS Daily for …

-

Lake George Sewage Flushing – Page Profile – Spreely

The Massive Poisoning of Lake George and Lake Champlain This is the page view page. Spreely.com, The Social Network For Free People. No Censorship, No Shadow Bans, No BS.

-

Follow the Money … The Oligarchs of Paper, Mill Toxins and …

With every cycle of the Pumping and Dumping of Lake George the Warren County Banks and Empire State poisoned The Hudson and Lake Champlain with RECKLESS DISREGARD …. Using these National Treasures as OPEN SEWERS for Their Greed and Aspirations for …

-

New York State a very Shitty Record | Trillions Stolen …

MULTIPLE Federal Agencies and the State of Vermont FINGER New York State The State of New York Are The Perpetrators They Laugh All The Way To The BANKS. The GARGANTUAN Poisoning of Lake Champlain was caused by the GLENS FALLS BANKS , The Ticonderoga, Lake George and Glens Falls Paper Companies ( International Paper ).

-

Lake George NY Flushing the Leachate Poisoning … – Vimeo

14:28Mar 08, 2017 · Lake George NY Flushing the Leachate Poisoning Lake Champlain. from Isacc Witham. 2 years ago. For decades the State of New York complained of Dock and Boat House, Island and Shoreline Damages caused by INTERNATIONAL PAPER CORPORATION. The shocking reality is New York State Conservation Department and EVCON / DEC with the Lake George …

-

Author: Isacc Wi

-

CROOKED DEVELOPERS & BANKING COLLAPSE

CROOKED DEVELOPERS & BANKING COLLAPSE